Tax wealth, tackle inequality

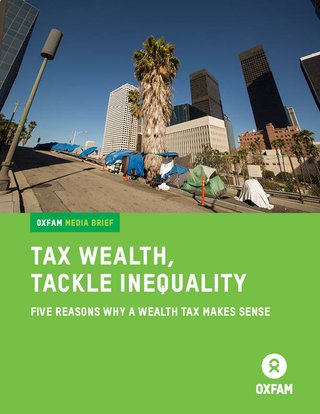

Wealth inequality in the US is more extreme and dangerous than income inequality; and we need to change our approach, so we effectively tax wealth as well as income. We offer five reasons why a wealth tax makes sense.

At a time when the ultrawealthy are amassing historic and dangerous levels of wealth, a federal wealth tax offers a vital and necessary tool for directly redressing extreme wealth inequality, as well as advancing racial justice, tackling the climate crisis, and protecting democracy. It also offers a reminder that today’s debt-ceiling gridlock is a consequence of giving tax breaks to the ultrawealthy.

To be clear: Extreme wealth concentration is at a record high in the United States, and has surpassed the peak of the Gilded Age of the late 19th century. Wealth is also highly stratified by race and gender, with billionaires and ultra-millionaires almost exclusively white and disproportionately male.